So using the example of EURUSD the Euro is the base currency and the US Dollar is the quote currency. At other times especially when prices are moving slowly it pays to try to buy at the bid or below or sell at the ask or higher.

Remember from the lesson on Forex currency pairs that the base currency is the one in front while the quote currency is the second.

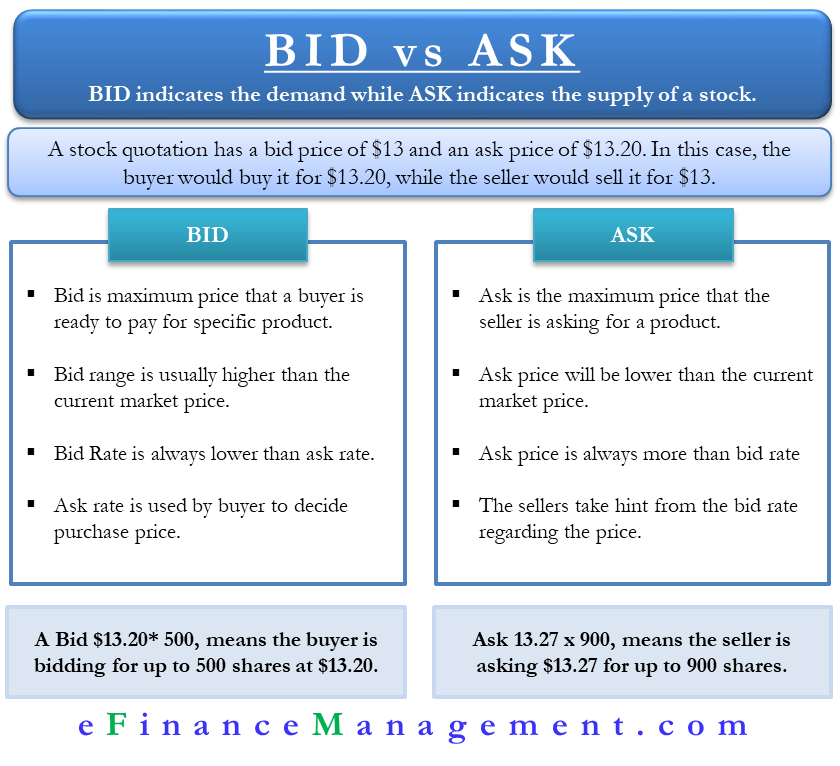

What does it mean when ask is higher than bid. Bid yields are always higher than ask yields because if the buyer were willing to take a yield that was equal to or less than the ask yield then the seller would sell the bond to the buyer at. Focus on the volume instead of the price. It is always lower than the Ask Price.

You can see the bid and ask prices for a stock if you have access to the proper online pricing systems and youll notice that they are never the same. A large bid size generally equates to high demand for a stock. The ask price is always a little higher than the bid priceYoull pay the ask price if youre buying the stock and youll receive the bid price if you are selling the stockThe difference between the bid and ask price is.

A large ask size translates into high supply. Before the advent of high frequency trading algorithms you could sit and watch the bid ask prices on Level 1 and come to some sort of conclusion of where the market was likely to break. The difference between the two is commonly known as the bid-ask spread and during normal trading the ask is always higher though not by the same amount than the bid.

HFTs would be able to make these markets because of the gap between exchange fees. So what should people do. The bid price will always be smaller than the ask price.

When the bid size for a stock is larger than the ask size demand outstrips supply and its likely that the stock price will rise On the other hand an ask size larger than the bid size indicates an oversupply of the stock in which case the price is likely to fall. Popular securities that trade in high volume are considered very liquid. These prices are rarely the same.

If you are buying a stock you pay the ask price. If you sell a stock you receive the bid price. First crossed and locked markets are forbidden by regulators.

Buyers use Ask rate. The stock price will remain where it previously traded. Similarly if a seller reduces their offer price to meet the highest bid price the latter is the price at which a trade will be executed.

He can see the total volume of Bid and ask. Ask price also called offer price asking price or simply offer or ask is the lowest price a seller will accept for the security. If the bid is exhausted the next best price is a lower price while the next best ask price is a higher one.

Similarly always selling at the bid means a slightly lower sale price than selling at the offer. It is an important factor to take into consideration when trading securities as it is essentially a hidden cost that is incurred during trading. Where bid ask spread can become troublesome is in two scenarios.

When the ask volume is higher than the bid volume the buying is. Crossed orders are where one exchange has a higher bid than anothers ask or a lower ask than anothers bid. A locked market is where a bid on one exchange is equal to the ask on another.

Popular securities that are highly liquid will often have a bid-ask spread that is less than a penny or two per share. Ask of 19 x 115 means that there are potential sellers willing to sell at this price. The ask price is usually higher than the bid price.

Equities that are scarcely traded usually have a wide spread between bid and ask. The spread is the difference between the current bid and ask prices. It is always higher than the bid rate.

Should a buyer lift their bid price to meet the lowest ask price then the trade will be done at the ask price. A bid of 15 x 120 means that the potential buyers are bidding at 15 for up to 120 shares. We researched the issue that when the bid volume is higher than the ask selling pressure is stronger.

The bid and ask are always fluctuating so its sometimes worth it to get in or out quickly. Bid-ask pricing is very. The ask price will always be higher than the bid price because any ask price at or below the current bid price will just automatically fill existing bid orders until the lowest ask is once again above the highest bid.

A stock trader may have access to the level II quotes. Sellers use Bid rate. The bid-ask spread benefits the market maker and represents the market makers profit.

And the more liquid a security is the lower its bid-ask spread typically is. When the bid volume is higher than the ask volume the selling is stronger and the price is more likely to move down than up. The difference between the bid and ask prices is referred to as the bid-ask spread.

The terms spread or bid-ask spread is essential for stock market investors but many people may not know what it means or how it relates to the stock marketThe bid-ask spread can affect the. In the current trading climate there are supercomputers sending millions of orders that are cancelled before a transaction takes place. Considering the Bid-Ask Spread.

From previous experiences most of the time Ask is always higher than bid.

Bid And Ask Definition Example How It Works In Trading

Bid And Ask Definition Example How It Works In Trading

Bid Vs Ask How Buying And Selling Work Warrior Trading

Bid Vs Ask How Buying And Selling Work Warrior Trading

How To Invest 10000 Dollars Right Now Best Way To Invest Investing Business Ideas For Ladies

How To Invest 10000 Dollars Right Now Best Way To Invest Investing Business Ideas For Ladies

Forexuseful Bid And Ask Price Find Out How To Interpret The Bid And Ask Price On The Forex Quote Screen W Trading Quotes Trading Charts Learn Forex Trading

Forexuseful Bid And Ask Price Find Out How To Interpret The Bid And Ask Price On The Forex Quote Screen W Trading Quotes Trading Charts Learn Forex Trading

The Bid Ask Spread Options Trading Guide Projectoption

Bid Vs Ask How To Interpret Buying And Selling Pressure When Trading

Bid Vs Ask How To Interpret Buying And Selling Pressure When Trading

Bid And Ask Definitions Examples And Strategies For 2021

Bid And Ask Definitions Examples And Strategies For 2021

What S The Difference Between Bid Price And Ask Price Be The Budget

What S The Difference Between Bid Price And Ask Price Be The Budget

Bid Vs Ask All You Need To Know

Bid Vs Ask All You Need To Know

0 comments:

Post a Comment