For example if the current price quotation for the stock of ABC Corp. From the research trading errors can plunge the stocks price down to the floor price.

The Bid-Ask Spread.

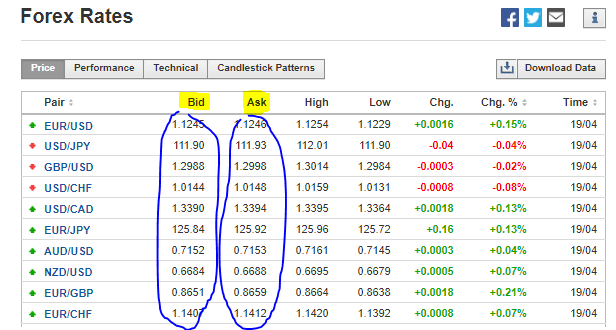

What does it mean ask and bid. As a rule you buy it often higher than the ask price. Day trading markets have two separate prices known as the bid and ask prices which respectively means the buying and selling prices. What does red and green mean.

Tight bid ask spreads are very important because they help you to get a better fill price. So why is the bid and ask price for this stock so different. It does not matter whether bid ask or ask bid I see red and green regardless of prices or comparisons.

It also determines how trading is done. However this is simply the monetary value of the spread. In other words bid and ask refers to the best price at which a security can be sold andor bought at the current time.

The order might be detected by high-frequency traders and the price plummetted immediately. Do I really need to know about the details of bid vs ask pricing and order flow. The ask is the current lowest price at which you could buy.

What Does Bid Vs Ask Spread Mean When Trading Stocks. 41 Without details those symbols represent different markets. Precision is key to their success in both arenas.

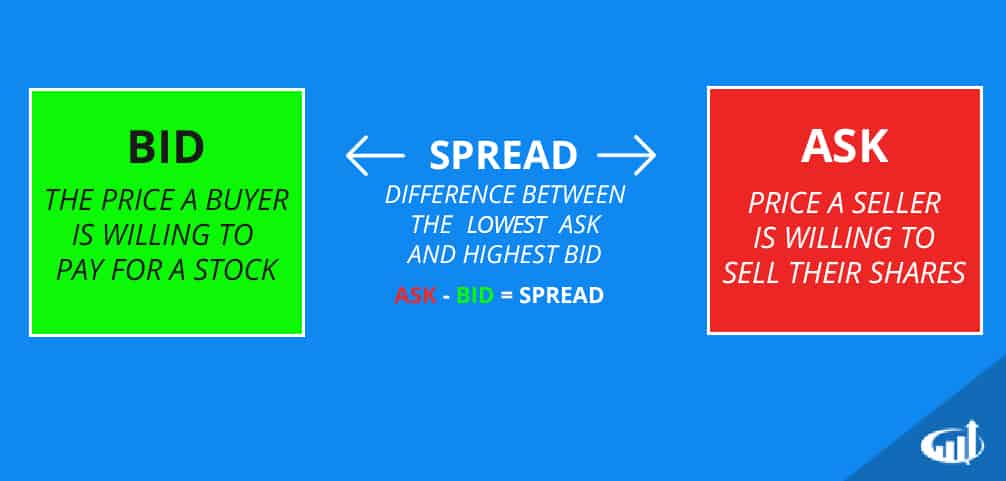

The bid for the buying side and the ask for the selling side. The bid ask spread comes from taking a look at the bid vs ask price. In a bid vs ask if it has a large spread does this indicate that it is harder to get what you paid for it back in return or say the market price.

Or can you always get the market sale if the price is up. If you take a look the call options are situated to the left the puts to the right and the strike price down the middle. The term bid and ask refers to the best potential price that buyers and sellers in the marketplace are willing to transact at.

A stocks bid is the price a buyer is willing to pay for a stockOften times the term bid refers to the highest bidder at the time. After realize the two terms we should know another term bid-ask spread. Represents the cumulative volume of buy and sell orders at a set price.

It was found that the Bid was higher than the Ask. I have tried for a couple of days how to have only US markets all. The difference between the highest bid and the lowest ask on the order book.

The distance between these two prices can vary and affect whether a particular market can be traded. A large bid and ask spread is usually caused by one of the following 2 conditions. 3 Bid and Ask.

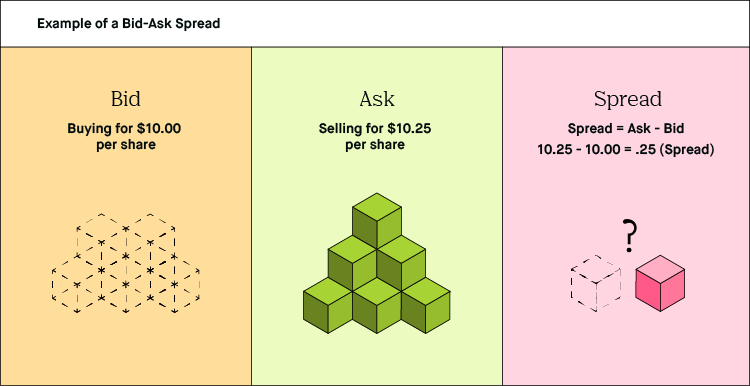

You may be thinking. 4 Again it may be red green and white. If a bid is 1005 and the ask is 1006 the bid-ask spread would then be 001.

Understanding Bid and Ask. For example due to fat-finger error one stock lost 38 of its value. Whereas the bid and ask are the best potential prices that buyers and sellers are willing to transact at.

In the previous example with Apple stock the bidask spread was only 004. Have a spread too wide and you miss the throw. The terms spread or bid-ask spread is essential for stock market investors but many people may not know what it means or how it relates to the stock marketThe bid-ask spread can affect the.

The difference between the bid price and the ask price is called the bid-ask spread. The answer is yes. The ask price is the price a seller is willing to sell hisher shares forOften times the term ask refers to the lowest selling price at the time.

If that makes sense. The option chain above shows the volume open interest and bid vs. Bottom line regardless of what you see on the bid and ask prices you can focus your attention on the time and sales to see where people are placing their money.

In this example. The bid-ask spread can be measured using ticks and pipsand each market is measured in different increments of ticks and pips. The current stock price youre referring to is actually the price of the last tradeIt is a historical price but during market hours thats usually mere seconds ago for very liquid stocks.

An order listed on the sell side of the order book. Ask price is the value point at which the seller is ready to sell and bid price is the point at which a buyer is ready to buy. The average investor contends with the bid and ask spread as an implied cost of trading.

A current glimpse and the bid-ask does change all the time has the stocks bid at 18924 and the ask is at 18928 - for a bid-ask spread of four cents. Ask spread for a series of Apple AAPL options. The bid depth is the cumulative volume of current buy orders at the price or higher.

If you would like to sell gold a broker will offer to buy it for. Veteran traders throw terms like bid vs ask around like NFL players throw a football. The difference between the bid and ask price is called the spread and in this example the spread is 060.

Low liquidity stocks. Updated February 08 2021. Bid-Ask Spread is typically the difference between ask offersell price and bid purchasebuy price of a security.

The bid ask spread for most pairs is considerably larger during the three hours immediately after the New York session Always check the bid ask spread before placing a trade I hope this lesson has helped you to better understand the Forex bid ask spread as well as when to take extra care and watch for larger-than-usual spreads.

What S The Difference Between Bid Price And Ask Price Be The Budget

What S The Difference Between Bid Price And Ask Price Be The Budget

Bid And Ask Definitions Examples And Strategies For 2021

Bid And Ask Definitions Examples And Strategies For 2021

Bid Vs Offer Price Top 4 Differences With Infographics

Bid Vs Offer Price Top 4 Differences With Infographics

Bid Ask And Spread Level 2 Day Trading Strategies

Bid Ask And Spread Level 2 Day Trading Strategies

Bid And Ask Definition Example How It Works In Trading

Bid And Ask Definition Example How It Works In Trading

Axiory Forex Trading Academy Beginner To Advanced Articles

Axiory Forex Trading Academy Beginner To Advanced Articles

Bid Vs Ask How Buying And Selling Work Warrior Trading

Bid Vs Ask How Buying And Selling Work Warrior Trading

0 comments:

Post a Comment